Introduction

In today’s evolving insurance landscape, the role of a POS agent (Point of Sale agent) has emerged as a rewarding and flexible career opportunity. Whether you're a student, homemaker, retired professional, or entrepreneur, becoming an Insurance POS Agent allows you to earn income by selling insurance products with minimal investment and training.

What is an Insurance POS Agent?

A Point of Sale (POS) Agent is a certified individual authorized by IRDAI (Insurance Regulatory and Development Authority of India) to sell specific insurance products directly to customers. POS agents act as intermediaries between insurance companies and the public, focusing on simple, pre-approved products that require minimal documentation.

Key Responsibilities of a POS Agent

Explaining insurance policies and their benefits to potential clients

Assisting clients in choosing the right insurance product

Collecting documents and completing KYC formalities

Helping with policy issuance and premium collection

Providing after-sales service and support

Types of Insurance You Can Sell as a POS Agent

As a POS agent, you are allowed to sell simplified insurance products like:

Life Insurance:

Term plans

Endowment policies

POS simplified life insurance products

Health Insurance:

Individual health plans

Family floater policies

Personal accident cover

General Insurance:

Motor insurance (car, bike)

Travel insurance

Home insurance

These policies are pre-underwritten, easy to understand, and require limited paperwork — making the sales process fast and straightforward.

Eligibility Criteria to Become a POS Insurance Agent

Becoming a POS agent is easier than becoming a traditional insurance agent. Here’s what you need:

Minimum Age: 18 years

Educational Qualification: At least Class 10 (10th pass)

Training: 15 hours of mandatory IRDAI-approved training

Certification: Clear a basic exam post-training

No prior insurance or sales experience required!

How to Become a POS Agent – Step-by-Step Process

Choose an Insurance Company or Broker:

Many insurers and online aggregators offer POS agent programs (e.g., LIC, ICICI Lombard, HDFC ERGO, Policybazaar, etc.)Register Online or Offline:

Provide basic KYC documents (ID proof, address, education certificate, PAN card)Undergo 15-Hour Training:

Conducted online or in person, depending on the providerTake the Certification Exam:

A simple test based on the training modulesStart Selling:

Once certified, you’ll get a POS ID and access to a digital platform or mobile app for selling insurance policies

Benefits of Becoming an Insurance POS Agent

Low Entry Barrier

No degree or prior experience needed

Unlimited Income Potential

Earn commissions on every policy you sell

Flexible Working Hours

Work from home or part-time — perfect for students, housewives, or retirees

Work Digitally

Most companies offer mobile apps and portals to issue policies instantly

Growing Industry

With increasing insurance awareness in India, demand for insurance products is soaring

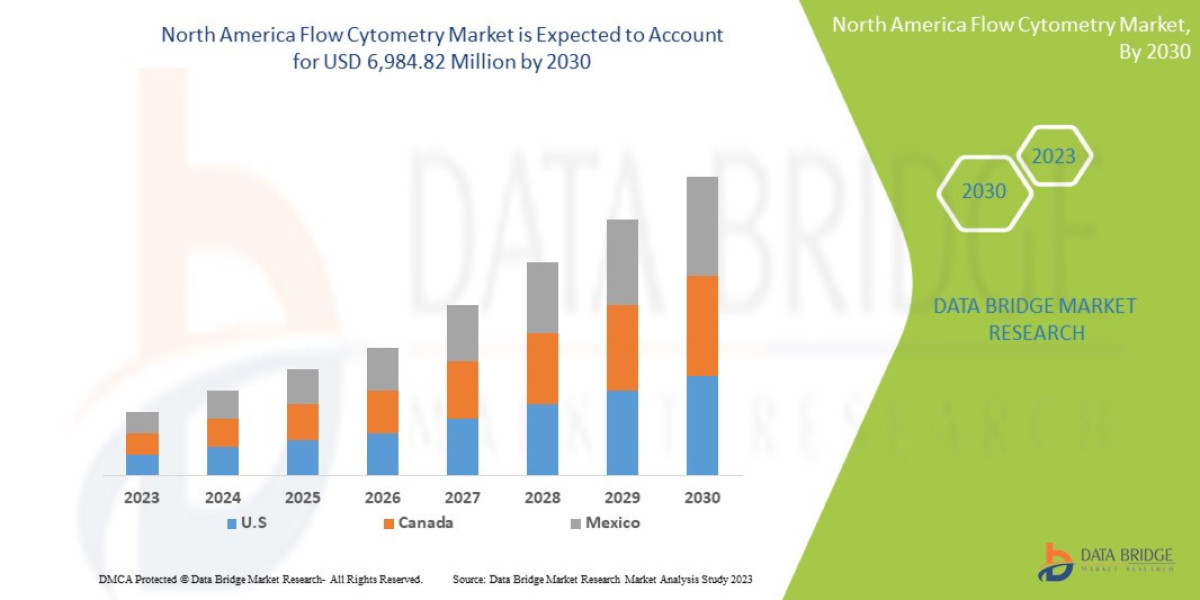

How Much Can a POS Agent Earn?

POS agents earn commissions on every sale. The exact amount depends on the type of policy and premium amount.

Product Type | Commission Range |

Life Insurance | 10% – 20% |

Health Insurance | 15% – 25% |

Motor Insurance | 10% – 15% |

For example, if you sell a health policy with a ₹20,000 premium and your commission is 20%, you earn ₹4,000 on a single policy!

Top Companies Offering POS Agent Opportunities in India

LIC (Life Insurance Corporation of India)

HDFC Life

ICICI Lombard

Tata AIG

Star Health

Digit Insurance

Policybazaar

Coverfox

RenewBuy

Paytm Insurance

These companies provide all the tools and training needed to help you succeed as a POS agent.

FAQs on Insurance POS Agents

Q. Is a POS agent the same as an insurance agent?

No. A POS agent sells simplified, pre-approved products with minimal documentation. Traditional agents can sell a wider range but require more training.

Q. Can I become a POS agent with multiple companies?

Yes, you can associate with multiple insurance providers or aggregators.

Q. Is it mandatory to sell a certain number of policies?

Most companies don’t have strict targets, but staying active helps maintain your license and income stream.

Final Thoughts

Becoming an Insurance POS Agent is a great way to start earning from home with low risk and high potential. Whether you're looking for a side hustle or a full-time income, the insurance industry offers a stable and rewarding career path.

If you’re good at communication and have a strong network, this could be the perfect opportunity for you. So why wait?

Start your journey as an Insurance POS Agent today and unlock a world of earning potential and professional growth!