Artificial Intelligence in Fintech Market, By Component (Solutions and Services), Deployment Mode (Cloud and On-Premises), Application (Virtual Assistant, Business Analytics and Reporting, Customer Behavioural Analytics and Others) – Industry Trends and Forecast to 2029.

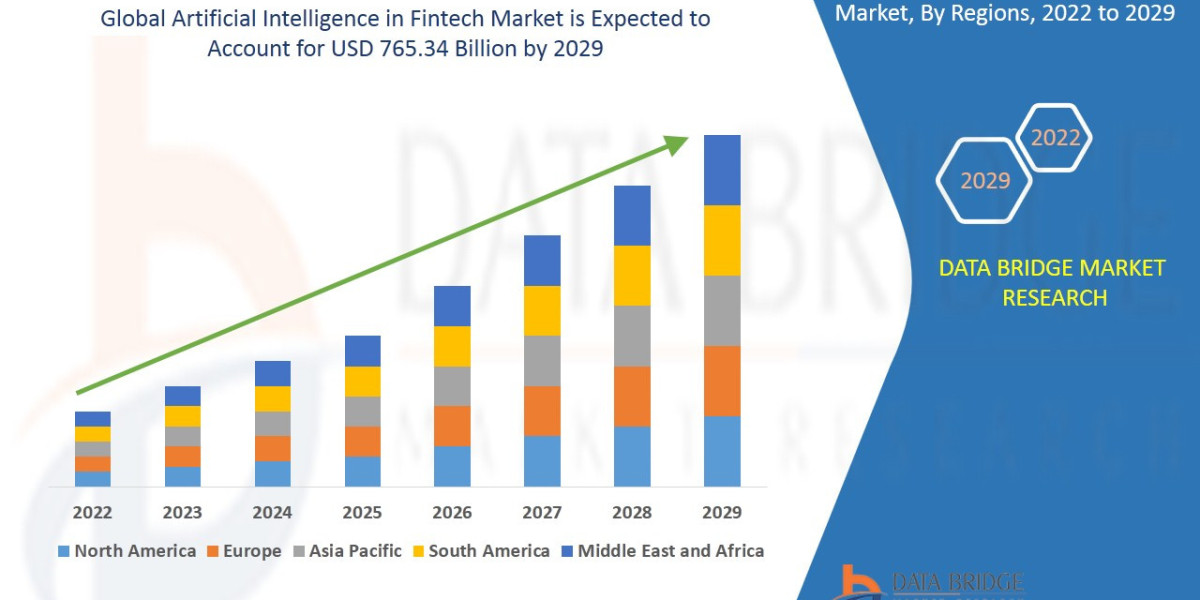

Data Bridge Market Research analyses that the artificial intelligence in fintech market value, which was USD 13.14 billion in 2021, is expected to reach the value of USD 765.34 billion by 2029, at a CAGR of 66.20% during the forecast period. “Cloud" accounts for the largest deployment mode segment in the artificial intelligence in fintech market owing to the growing number of small and medium scale enterprises.

This global Artificial Intelligence in Fintech Market research report is organized by collecting market research data from different corners of the globe with an experienced team of language resources. As market research reports are gaining immense importance in this swiftly transforming market place, Artificial Intelligence in Fintech Market report has been created in a way that you anticipate. Keeping in mind the customer requirement, this finest market research report is constructed with the professional and in-depth study of industry. It all-inclusively estimates general market conditions, the growth prospects in the market, possible restrictions, significant industry trends, market size, market share, sales volume and future trends.

This Artificial Intelligence in Fintech Market research report is formed with a nice combination of industry insight, smart solutions, practical solutions and newest technology to give better user experience. Data collection modules with large sample sizes are used to pull together data and perform base year analysis. To perform this market research study, competent and advanced tools and techniques have been used that include SWOT analysis and Porter's Five Forces Analysis. This Artificial Intelligence in Fintech Market report gives information about company profile, product specifications, capacity, production value, and market shares for each company for the year 2018 to 2015 under the competitive analysis study.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Artificial Intelligence in Fintech Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-ai-in-fintech-market

Artificial Intelligence in Fintech Market Overview

**Segments**

- On the basis of Component: Solutions, Services.

- On the basis of Application: Algorithmic Trading, Fraud Detection, Customer Service, Loans and Insurance, Personalized Services, Others.

- On the basis of Deployment Mode: Cloud, On-Premises.

Artificial Intelligence (AI) has significantly transformed the Fintech industry with its ability to process vast amounts of data, automate processes, and provide valuable insights in real-time. In the global AI in Fintech market, the segments play a crucial role in identifying the key areas of growth and opportunities within the industry. In terms of components, both solutions and services are integral to the market's functionality. Solutions encompass AI algorithms, platforms, and tools that enable Fintech companies to enhance their offerings, while services include consulting, integration, and support services to ensure the seamless implementation of AI technologies.

When considering applications in the AI in Fintech market, various sectors benefit from AI integration. Algorithmic trading utilizes AI algorithms to make trading decisions at speeds and frequencies beyond human capabilities. Fraud detection has been significantly bolstered by AI's ability to recognize patterns and anomalies in financial transactions, reducing risks for financial institutions. Customer service has also been revolutionized through AI-powered chatbots and virtual assistants, providing personalized and efficient services to clients. Moreover, AI is increasingly being used in loans and insurance for credit scoring, underwriting, and claims processing, leading to quicker and more accurate decisions. The versatility of AI applications in Fintech is evidenced by its usage in personalized services tailored to individual customer needs, as well as other emerging areas within the industry.

In the realm of deployment modes, the choice between cloud and on-premises solutions holds strategic significance for Fintech companies. Cloud deployment offers scalability, flexibility, and cost-effectiveness, allowing organizations to access AI capabilities without heavy upfront investments. On the other hand, on-premises deployment provides greater control, security, and customization options for companies handling sensitive financial data. Understanding the nuances of these deployment modes is essential for Fintech firms to align their AI strategies with their operational requirements and long-term objectives.

**Market Players**

- IBM Corporation

- Microsoft Corporation

- Alphabet Inc.

- Salesforce.com, Inc.

- Intel Corporation

- Amazon Web Services, Inc.

- Inbenta Technologies Inc.

- Next IT Corporation

- Oracle Corporation

- Nuance Communications, Inc.

The global AI in Fintech market is experiencing a paradigm shift driven by the convergence of artificial intelligence and financial technology. Market dynamics indicate a growing demand for AI solutions and services to enhance operational efficiency, mitigate risks, and deliver personalized experiences to customers. The intersection of AI and Fintech is catalyzing innovation across various segments, with a focus on driving value creation and differentiation in a highly competitive landscape. Market players are investing heavily in research and development initiatives to stay ahead of the curve and capitalize on the burgeoning opportunities presented by the digitization of financial services.

In terms of component segmentation, the differentiation between solutions and services underscores the holistic approach adopted by Fintech companies in leveraging AI technologies. While AI solutions provide the technical backbone for data analysis, predictive modeling, and decision-making, AI services complement these offerings by delivering implementation expertise, training, and ongoing support. This dual-component approach allows Fintech firms to integrate AI seamlessly into their operations and extract maximum value from their investments in cutting-edge technologies.

The application segmentation of AI in Fintech reflects the diverse use cases and transformative capabilities of artificial intelligence across the financial services spectrum. From algorithmic trading and fraud detection to customer service and personalized services, AI is reshaping traditional business models and empowering organizations to make data-driven decisions in real time. The advent of AI-driven applications in loans and insurance is revolutionizing risk assessment practices, enhancing operational efficiencies, and improving customer satisfaction levels. The seamless integration of AI across various Fintech applications signifies a shift towards a more agile, adaptive, and customer-centric financial ecosystem.

When analyzing the deployment mode segmentation of AI in Fintech, the choice between cloud and on-premises solutions has strategic implications for organizations seeking to optimize performance while managing costs and security concerns. Cloud deployment offers scalability, agility, and operational flexibility, making it an attractive option for Fintech companies looking to harness the power of AI without significant capital expenditures. On the other hand, on-premises deployment provides greater control, compliance, and customization capabilities, particularly for firms operating in highly regulated environments where data privacy and security are paramount.

In conclusion, the global AI in Fintech market presents a plethora of opportunities for market players to innovate, collaborate, and disrupt traditional financial services paradigms. By leveraging the key segments of components, applications, and deployment modes, Fintech organizations can harness the transformative potential of artificial intelligence to drive sustainable growth, enhance customer experiences, and stay competitive in an ever-evolving digital landscape. The convergence of AI and Fintech is not just a technological trend but a strategic imperative for firms looking to thrive in the future of finance.The global AI in Fintech market is witnessing a significant evolution driven by the convergence of artificial intelligence and financial technology. With the rapid advancements in AI capabilities, Fintech companies are leveraging these technologies to streamline operations, improve customer experiences, and drive innovation in the industry. The segmentation of the market into components, applications, and deployment modes provides insights into how AI is being utilized across various sectors within the Fintech landscape.

In terms of components, the market offers a range of AI solutions and services that are essential for Fintech companies to stay competitive and meet the evolving needs of their customers. AI solutions include algorithms, platforms, and tools that enable data analysis, prediction modeling, and decision-making processes. These solutions are pivotal in enhancing operational efficiency and driving growth within the Fintech sector. On the other hand, AI services such as consulting, integration, and support services play a crucial role in ensuring the successful implementation and utilization of AI technologies, allowing companies to maximize the benefits of their AI investments.

When looking at the applications of AI in Fintech, it is evident that the technology is being utilized across a wide range of sectors to optimize processes and deliver personalized experiences. Algorithmic trading, for example, leverages AI algorithms to execute trades with speed and accuracy beyond human capabilities, resulting in improved trading strategies and outcomes. Fraud detection is another critical application area where AI plays a key role in identifying suspicious patterns and anomalies in financial transactions, thereby enhancing security and reducing risks for financial institutions. Moreover, AI is transforming customer service by enabling chatbots and virtual assistants to provide personalized and efficient services to customers, leading to enhanced customer satisfaction and loyalty.

The deployment mode segmentation of AI in Fintech further demonstrates the strategic considerations that Fintech companies must evaluate when adopting AI technologies. Cloud deployment offers scalability, flexibility, and cost-effectiveness, making it an attractive option for companies looking to access AI capabilities without significant upfront investments. On-premises deployment, on the other hand, provides greater control, security, and customization options, which are crucial for companies handling sensitive financial data and operating in highly regulated environments.

In conclusion, the global AI in Fintech market is poised for continued growth and innovation as more companies recognize the value of AI in driving operational efficiencies, enhancing customer experiences, and gaining a competitive edge in the market. By understanding the key segments of components, applications, and deployment modes, Fintech organizations can strategically leverage AI technologies to transform their operations, unlock new opportunities, and address the evolving needs of the industry and consumers alike.

The Artificial Intelligence in Fintech Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-ai-in-fintech-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Pointers Covered in the Artificial Intelligence in Fintech Market Industry Trends and Forecast

- Artificial Intelligence in Fintech Market Size

- Artificial Intelligence in Fintech Market New Sales Volumes

- Artificial Intelligence in Fintech Market Replacement Sales Volumes

- Artificial Intelligence in Fintech Market By Brands

- Artificial Intelligence in Fintech Market Procedure Volumes

- Artificial Intelligence in Fintech Market Product Price Analysis

- Artificial Intelligence in Fintech Market Regulatory Framework and Changes

- Artificial Intelligence in Fintech Market Shares in Different Regions

- Recent Developments for Market Competitors

- Artificial Intelligence in Fintech Market Upcoming Applications

- Artificial Intelligence in Fintech Market Innovators Study

Browse More Reports:

Global 3D Printing Medical Devices Market

Global Omsk Hemorrhagic Fever (OHF) Treatment Market

Global Fully Autonomous Delivery Robots Market

Global Visual Search Market

Global Isolation Gowns Market

Global High Pressure Processing Equipment Market

Global Enzymatic Wound Debridement Market

Global Wooden Furniture Market

Global Sliding Sleeves Market

Global Electric Motorcycles Market

Global Compact Road Sweeper Market

North America Skin Tightening Market

North America Single Board Computer Market

Global Veterinary Hematology Analyzer Market

Middle East and Africa Rubber Peptizers Market

Global Antimicrobial Packaging Market

Europe Dental Silver Diamine Fluoride (SDF) Market

Global Advanced Glycation End Products (AGEs) Market

Global Digital Light Processing Technology Market

Global Automotive Engineering Market

Asia-Pacific Surface Disinfectant Market

Global Seminoma-associated Paraneoplastic Syndrome Market

Global Retail Bags Market

Global Buy Now Pay Later Services Market

Global Pelvic Congestion Syndrome Market

Global Tubular Ectasia of the Rete Testis (TERT) Market

North America Syndromic Multiplex Diagnostic Market

Global Healthcare Interoperability Solutions Market

Global Electrophysiology Ablation Catheters Market

Global Natural Berry Flavors Market

Global Undescended Testicle Market

Global Biodegradable Cups Market

Global Cold Chain Monitoring Market

Global Squash Seeds Market

Middle East and Africa Graft-Versus-Host Disease (GVHD) Treatment Market

Global Carbon Nanotubes Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com