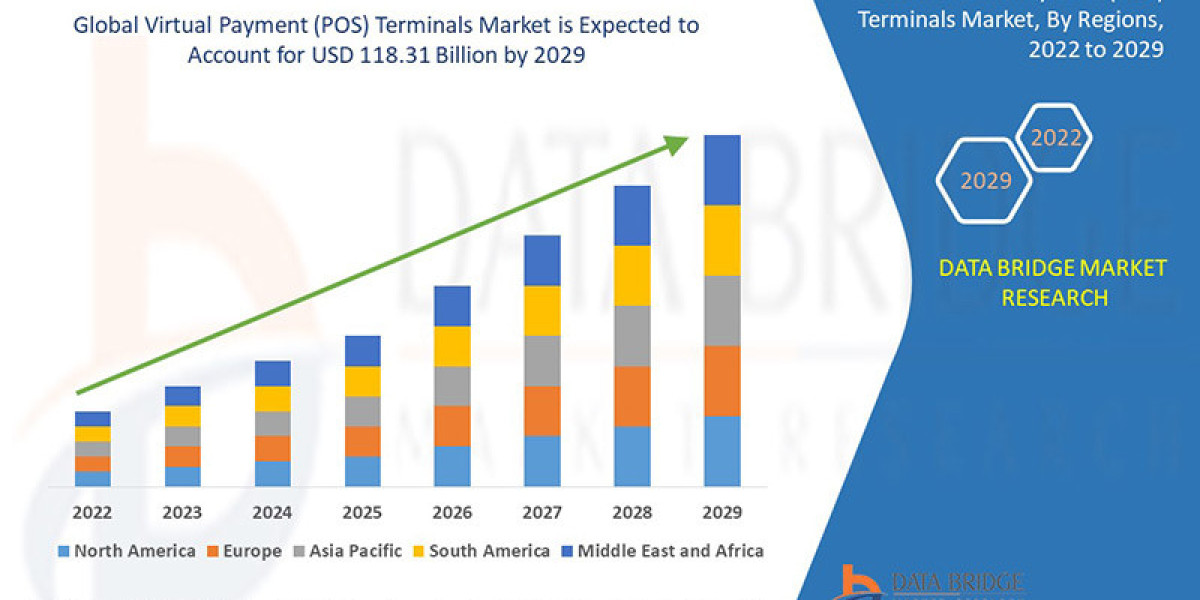

"Executive Summary Virtual Payment (POS) Terminals Market :

This Virtual Payment (POS) Terminals Market research report takes into account several industry verticals such as company profile, contact details of manufacturer, product specifications, geographical scope, production value, market structures, recent developments, revenue analysis, market shares and possible sales volume of the company. Businesses can gain current as well as upcoming technical and financial details of the industry to 2025 with this Virtual Payment (POS) Terminals Market report. Virtual Payment (POS) Terminals Market report has been mainly designed by keeping in mind the customer requirements which will ultimately assist them in boosting their return on investment (ROI).

The company profiles of all the top market players and brands with moves like product launches, joint ventures, mergers and acquisitions which in turn is affecting the sales, import, export, revenue and CAGR values are revealed in this Virtual Payment (POS) Terminals Market industry report. With this market report, it becomes easy to get an in-depth market analysis and thrive in this competitive environment. The report will surely aid in growing your sales and improve return on investment (ROI). Virtual Payment (POS) Terminals Market research report makes available wide-ranging analysis of the market structure along with evaluations of the various segments and sub-segments of the market.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Virtual Payment (POS) Terminals Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-virtual-payment-pos-terminals-market

Virtual Payment (POS) Terminals Market Overview

**Segments**

- **Type:** The virtual payment (POS) terminals market can be segmented based on the type into fixed and mobile POS terminals. Fixed POS terminals are traditional point-of-sale systems that are stationary and are commonly seen in retail stores and restaurants. On the other hand, mobile POS terminals are gaining popularity due to their portability and flexibility, allowing businesses to accept payments on-the-go.

- **Component:** The market can also be segmented by component, which includes hardware, software, and services. Hardware components include terminals, scanners, printers, and others. Software components encompass the POS software that manages transactions, inventory, and customer data. Services include installation, maintenance, and support for the POS system.

- **End-User:** The virtual payment (POS) terminals market can further be segmented by end-user into retail, hospitality, healthcare, entertainment, and others. Retail and hospitality sectors are major users of POS terminals for processing transactions. The healthcare sector is also adopting virtual terminals for easy billing and management of patient records.

**Market Players**

- **Verifone:** Verifone is a key player in the virtual payment (POS) terminals market, offering a range of secure and efficient payment solutions for businesses of all sizes.

- **Ingenico Group:** Ingenico Group is another prominent player known for its innovative POS terminals that cater to diverse industry needs and compliance requirements.

- **PAX Technology:** PAX Technology is a global leader in electronic payment solutions, providing secure and reliable POS terminals for various industries.

- **Square Inc.:** Square Inc. is a well-known player that offers a variety of POS solutions, including mobile card readers and point-of-sale software for small businesses.

- **Oracle Corporation:** Oracle Corporation provides comprehensive POS software solutions that integrate seamlessly with other business operations, making it a preferred choice for many enterprises.

The global virtual payment (POS) terminals market is witnessing significant growth due to the increasing adoption of cashless payment systems and the growing preference for contactless transactions. Factors such as enhanced security features, convenience, and improved customer experience are driving the market's expansion. The COVID-19 pandemic has further accelerated the shift towards digital payments, as consumers and businesses prioritize touch-free payment options to minimize physical contact. With technological advancements and the evolving retail landscape, the virtual payment (POS) terminals market is poised for continuous growth in the coming years.

The global virtual payment (POS) terminals market is undergoing a transformative period driven by the increasing digitalization of payment systems and the rising demand for contactless transactions. As businesses across various industries seek efficiency and enhanced customer experience, the adoption of virtual POS terminals is gaining momentum. This shift is primarily fueled by the convenience and security offered by virtual payment solutions, allowing businesses to streamline transactions and improve operational processes.

One of the key trends shaping the virtual payment (POS) terminals market is the convergence of online and offline retail channels. With the rise of omnichannel retailing, businesses are integrating their physical and digital storefronts to provide a seamless shopping experience for consumers. Virtual POS terminals play a crucial role in enabling this convergence by allowing retailers to accept payments across various touchpoints, including in-store, online, and mobile channels. This omnichannel approach not only enhances customer engagement but also drives sales and boosts loyalty.

Moreover, the growing adoption of cloud-based POS solutions is another significant trend in the virtual payment terminals market. Cloud-based POS systems offer scalability, flexibility, and cost-effectiveness, making them an attractive choice for businesses of all sizes. By leveraging cloud technology, businesses can access real-time data insights, streamline operations, and adapt to changing market conditions quickly. This shift towards cloud-based POS solutions is reshaping the market landscape, with vendors offering innovative solutions to meet the evolving needs of businesses in an increasingly digital world.

Another factor driving market growth is the increasing focus on data security and compliance with regulatory standards. With the rise in cyber threats and data breaches, businesses are placing a premium on payment security to protect customer information and maintain trust. Virtual POS terminals equipped with advanced security features, such as encryption and tokenization, are becoming essential for businesses looking to safeguard sensitive payment data. Additionally, adherence to industry regulations and standards, such as PCI DSS compliance, is critical for businesses operating in the virtual payment space.

In conclusion, the global virtual payment (POS) terminals market is dynamic and evolving, driven by factors such as the shift towards digital payments, the integration of online and offline channels, the adoption of cloud-based solutions, and a focus on data security. As businesses continue to prioritize efficiency, convenience, and customer experience, the demand for virtual POS terminals is expected to grow steadily. Market players are innovating and diversifying their offerings to cater to the changing needs of businesses across diverse industries, positioning the virtual payment terminals market for sustained growth and innovation in the years to come.The virtual payment (POS) terminals market is witnessing notable growth driven by several key factors that are shaping its trajectory. Among the pivotal trends impacting this market is the convergence of online and offline retail channels. The rise of omnichannel retailing has prompted businesses to integrate their physical and digital storefronts, aiming to offer a seamless shopping experience to consumers. Virtual POS terminals play a vital role in facilitating this integration by enabling retailers to accept payments across multiple touchpoints, including in-store, online, and mobile channels. This omnichannel approach not only enhances customer engagement but also drives sales and fosters customer loyalty, making it a crucial trend to watch in the POS terminals market.

Furthermore, the increasing adoption of cloud-based POS solutions is another significant trend reshaping the virtual payment terminals market landscape. Cloud-based POS systems provide businesses with scalability, flexibility, and cost-effectiveness, making them an appealing choice for companies of all sizes. By harnessing cloud technology, businesses can access real-time data insights, streamline operations, and swiftly adapt to changing market conditions. This shift towards cloud-based POS solutions is revolutionizing how businesses operate, with vendors continually introducing innovative solutions to meet the evolving needs of businesses in an increasingly digital ecosystem.

Another key driver of market growth is the heightened focus on data security and compliance with regulatory standards. In the face of escalating cyber threats and data breaches, businesses are prioritizing payment security to safeguard customer information and uphold trust. Virtual POS terminals equipped with advanced security features like encryption and tokenization are becoming indispensable for businesses seeking to protect sensitive payment data. Additionally, adherence to industry regulations and standards such as PCI DSS compliance is paramount for businesses operating in the virtual payment space, underscoring the critical role of robust security measures in the POS terminals market.

In conclusion, the virtual payment (POS) terminals market is dynamic and evolving, propelled by trends such as the convergence of online and offline retail channels, the adoption of cloud-based solutions, and a robust focus on data security. As businesses increasingly prioritize efficiency, convenience, and customer experience, the demand for virtual POS terminals is poised for steady growth. Market players are continuously innovating and expanding their offerings to cater to the evolving requirements of businesses across various industries, positioning the virtual payment terminals market for sustained growth and advancement in the foreseeable future.

The Virtual Payment (POS) Terminals Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-virtual-payment-pos-terminals-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

What insights readers can gather from the Virtual Payment (POS) Terminals Market report?

- Learn the behavior pattern of every Virtual Payment (POS) Terminals Market -product launches, expansions, collaborations and acquisitions in the market currently.

- Examine and study the progress outlook of the global Virtual Payment (POS) Terminals Market landscape, which includes, revenue, production & consumption and historical & forecast.

- Understand important drivers, restraints, opportunities and trends (DROT Analysis).

- Important trends, such as carbon footprint, R&D developments, prototype technologies, and globalization.

Browse More Reports:

Global Railcar Loader Market

Global Wireless Electric Vehicle (EV) Charging Market

Global Egg-free Mayonnaise Market

Asia-Pacific Cleanroom Technology Market

Global Benign and Malignant Soft Tissue Tumors Treatment Market

Global Arginase Deficiency Market

Asia-Pacific Walk-In Refrigerators and Freezers Market

Europe Respiratory Masks Market

Global Rubber Additives Market

Global Gusseted Bags Market

Global Stoma/Ostomy Care Market

Global Litho Laminated Packaging Market

Global Gummy Vitamin Market

Global Cleaner and Degreaser AfterMarket

Asia-Pacific Session Initiation Protocol (SIP) Trunking Services Market

Middle East and Africa Treasury Software Market

Global Polyacrylic Acid Market

Global Rice Shampoo Bar Market

Global Lactose Intolerance Treatment Market

Global Active Metal Brazed (AMB) Ceramic Substrate Market

Global Treasury Software Market

Global Light-Emitting Diode (LED) Digital Signage Market

Middle East and Africa Active, Smart and Intelligent Packaging Market

Global Cardiac AI Monitoring and Diagnostics Market

Global Progressive Supranuclear Palsy (PSP) Treatment Market

Asia-Pacific Analytical Laboratory Services Market

Global E-Lan Metro Ethernet Services Market

Asia-Pacific Identity Verification Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com